Venture Capital Firms: Who They Are and How They Make Decisions

Venture Capital Firms are the primary institutional backers for startups. In this post, we'll explore who these investors are, how they make money, and their unique characteristics. By understanding their structure and motivations, you can better prepare to secure their investment and support.

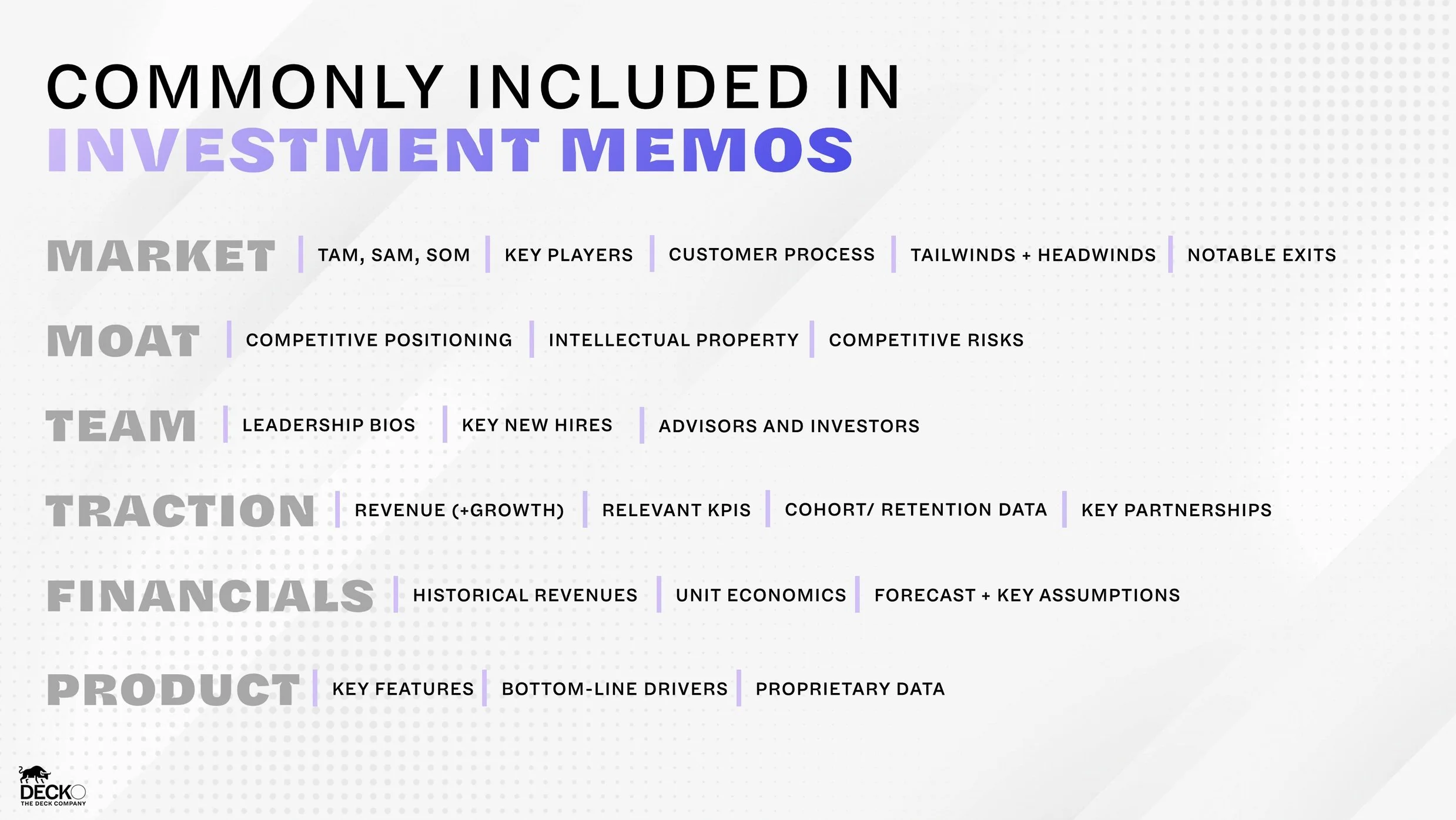

Venture Capital Firms will often use your pitch deck as a jumping-off point for due diligence and to build out their investment memos. That means your pitch deck is an opportunity to guide the investor through their diligence process and make an impact on the narrative of their investment memos.

Check out this handy checklist on what investors often include in their investment memos below:

Understanding Venture Capital Firms: Early-Stage vs. Late-Stage

Venture Capital Firms are professional investment entities that specialize in funding startups at various stages of their development. These firms are backed by Limited Partners (LPs) who provide the capital that VCs invest in high-potential companies. The primary goal of VCs is to identify startups that can scale rapidly and deliver substantial returns.

Early-Stage Venture Capital Firms

Early-Stage VC Firms typically invest in startups during the initial phases of their development, from Pre-Seed to Series A. Their focus is on identifying startups with strong growth potential that are just beginning to establish their market presence.

High Risk, High Reward: Early-Stage VCs take on more risk than their Late-Stage counterparts because they invest in companies that are still in the process of proving their business model. However, the potential rewards are also higher, as these investors get in on the ground floor and can benefit from significant equity stakes.

Company-Building Focus: Early-Stage VCs are not just financial backers; they are active participants in the company-building process. They provide resources beyond capital, including mentorship, strategic advice, and introductions to key industry players. Their involvement is aimed at helping startups scale rapidly and successfully navigate the challenges of early growth.

Smaller Investments, Larger Impact: Investments from Early-Stage VCs are typically smaller in dollar terms compared to Late-Stage investments, but they can have a substantial impact on the startup’s trajectory. These funds are often used to build out the team, develop the product, and gain initial market traction.

Late-Stage Venture Capital Firms

Late-Stage VC Firms, on the other hand, focus on more mature startups that have demonstrated significant traction and are on the verge of scaling or preparing for an exit, such as an IPO or acquisition. These firms typically invest in Series B rounds and beyond.

Lower Risk, More Data-Driven: Late-Stage VCs invest in companies that have already proven their business model and achieved substantial revenue. Their investments are typically less risky than those of Early-Stage VCs because they are based on extensive data and validated market performance.

Scalability and Exit Focus: Late-Stage VCs are particularly interested in startups that have the potential for rapid scaling and a clear path to an exit. Their goal is to position these companies for a successful IPO or acquisition, ensuring a strong return on their investment.

Larger Investments for Growth Acceleration: Investments from Late-Stage VCs are generally much larger than those from Early-Stage VCs, reflecting the reduced risk and the need for significant capital to fuel expansion. These funds are often used for scaling operations, entering new markets, or making strategic acquisitions.

The "2 & 20" Model: How Venture Capital Firms Make Money

Understanding how VCs are compensated can shed light on their motivations and decision-making processes. Most VC firms, whether Early-Stage or Late-Stage, operate on a "2 & 20" model:

2% Management Fee: VCs typically receive an annual management fee of 2% of the total fund size. This fee is used to cover operational expenses, including salaries, office space, and due diligence costs. This steady income allows VC firms to maintain their operations while they wait for their investments to mature.

20% Carried Interest: VCs also earn a percentage of the profits generated by the fund, usually 20%. This is known as "carried interest" and is a key driver for VCs to pursue high-return opportunities. Since the majority of startups in a VC's portfolio may not yield significant returns, the few that succeed need to compensate for the losses and deliver substantial profits.

Limited Partners: The Source of Capital

VC firms raise money from Limited Partners (LPs), who include high-net-worth individuals, family offices, pension funds, endowments, and large corporations. These LPs entrust their capital to VCs with the expectation that it will be invested in high-growth startups that can generate significant returns.

Investment Mandate: Each VC fund typically has an investment mandate that outlines the types of startups they will invest in, including the stage, industry, geographic location, and business model. If your startup doesn’t fit within a fund’s mandate, the chances of securing investment are slim.

Diversified Portfolio: To manage risk, VCs invest in a portfolio of startups, knowing that only a few will likely succeed. This portfolio approach allows them to spread their bets across multiple companies, increasing the likelihood of a significant return from at least one or two successful investments.

What Venture Capital Firms Look For

Despite their differences, both Early-Stage and Late-Stage VC Firms share some common criteria when evaluating potential investments. However, the emphasis on certain factors can vary depending on the stage of investment.

Market Opportunity and Size

Both Early-Stage and Late-Stage VCs prioritize the size of the market your startup is targeting. They want to invest in companies that address large, growing markets where there is significant potential for scale.

Total Addressable Market (TAM): Clearly define the total addressable market for your product or service. VCs are looking for markets that are not only large but also have room for growth. A compelling TAM shows that there is ample opportunity for your startup to capture a meaningful share of the market.

Market Trends and Timing: Discuss the trends that are driving growth in your market. Are there technological advancements, regulatory changes, or shifts in consumer behavior that make this the right time for your startup? Timing is crucial—VCs want to invest in companies that are entering the market at the right moment to capitalize on emerging opportunities.

Scalability and Growth Potential

Scalability is a key factor for both Early-Stage and Late-Stage VCs. They want to see that your business model is not only viable but also capable of growing quickly with the right investment.

Scalable Business Model: Explain how your business model can scale. VCs are interested in startups that can grow without a proportional increase in costs. Whether it’s through technology, network effects, or economies of scale, demonstrate how your startup can achieve significant growth efficiently.

Path to Expansion: Outline your strategy for expanding your business. This might include entering new markets, developing additional product lines, or scaling operations. Early-Stage VCs are looking for a clear plan for initial growth, while Late-Stage VCs want to see a roadmap for aggressive scaling and market dominance.

Team and Execution

The founding team is often the most critical factor in a VC’s investment decision. VCs invest in people as much as they invest in ideas. They want to back teams that have the skills, experience, and resilience to turn a vision into reality.

Founder Experience: Highlight the experience of the founding team, especially in relevant industries or previous startups. VCs look for founders who have a track record of success or unique insights into the market they’re targeting.

Team Dynamics: VCs assess the dynamics within the founding team. Do the founders have complementary skills? Is there a clear leadership structure? Strong team dynamics can be a significant indicator of a startup’s potential for success.

Ability to Execute: Beyond just having a good idea, VCs want to see that your team can execute. This includes your ability to develop a product, acquire customers, and manage growth. Provide examples of how your team has successfully executed in the past, whether in this startup or in previous ventures.

Traction and Validation

VCs look for evidence that your startup is gaining traction in the market. This can come in various forms, such as customer growth, revenue, partnerships, or product adoption. Traction serves as proof that your business model works and that there is demand for your product.

Key Metrics: Present key metrics that demonstrate traction, such as monthly recurring revenue (MRR), user growth, customer acquisition cost (CAC), and lifetime value (LTV). These metrics give VCs insight into how well your startup is performing and its potential for future growth.

Milestones Achieved: Highlight significant milestones your startup has already reached, such as product launches, customer acquisitions, or revenue growth. Early-Stage VCs may be more interested in initial traction and validation, while Late-Stage VCs will want to see sustained growth and market leadership.

Risk and Mitigation

While VCs are willing to take risks, they want to understand what those risks are and how you plan to mitigate them. Addressing potential risks upfront shows that you are prepared and have thought through the challenges.

Identifying Risks: Be transparent about the risks your startup faces. This could include market risks, competitive risks, operational risks, or financial risks. VCs appreciate founders who have a realistic understanding of the challenges ahead.

Mitigation Strategies: Explain the strategies you have in place to mitigate these risks. Whether it’s building a diverse customer base, securing intellectual property, or having a strong cash reserve, showing that you have a plan to address potential risks can increase investor confidence.

The Value of Venture Capital Firms

Both Early-Stage and Late-Stage Venture Capital Firms do more than just provide capital—they become partners in your journey, offering resources, expertise, and connections that can help your startup scale. By understanding what these investors are looking for and positioning your startup accordingly, you can increase your chances of securing the funding needed to take your business to the next level.

In the next article, we’ll dive deep into Early Stage venture capital firms and explore what they’re looking for in each pitch deck they see.